Background:

Amazon, Google and Starbucks were implicated, in 2012, in a massive case of tax avoidance in the UK.

They were accused of “exporting” their profits from the United Kingdom (Where the Corporate Tax bracket was 24% in 2012), to other countries such as the United States and the Netherlands where the corporate tax bracket is lower (16%)

*

Corporate happenings seem to have moved from the distant business pages to the forefront of the headlines. The most recent specimen being all the hooplah surrounding 2012’s alleged UK Tax avoidance by US Corporate giants – Amazon, Google and Starbucks, who through a series of complicated financial and legal maneuvering managed to export their tax liabilities to other countries where the tax brackets were more favorable.

The controversy lies not only in the fact that three huge reputed companies went about avoiding tax payments in a country where they operate, but that apparently no laws or regulations were broken or breached.

I reiterate the “legal maneuvering” phrase in my first paragraph. This is tax avoidance, not evasion. Hence the bifurcated opinions and views on the matter.

On the one hand these companies operate and made substantial amounts of money in the United Kingdom, for which they did not pay anywhere close to what should have been their share of tax. Depriving the state and by extension it’s citizens of money that might otherwise have been put into welfare or development activities.

And on the other, they are now being asked to pay more tax than is legally necessary, which seems to be unfair to them to say the least. (Remember Tax avoidance is reducing your tax liability through legally acceptable means)

*

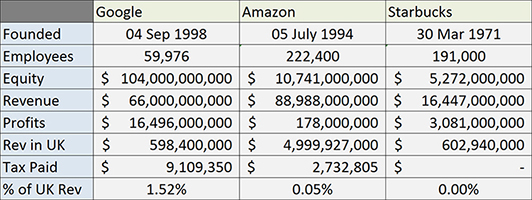

For Tax year 2012

*

On the morning of the 12th of November, senior executives from the named companies were questioned by Member’s of Parliament sitting as the Public Accounts Committee (Chaired by MP Margaret Hodge) to investigate possible fraud and tax evasion.

Amazon – Andrew Cecil, Director, Amazon

Google – Matt Brittin, Chief Executive, Google UK

Starbucks – Troy Alstead, Chief Financial Officer, Starbucks

*

Amazon’s stated defense was that they have not made any attempts at tax avoidance, and are in fact a high tax paying corporation with a global average bracket of 33%.

Google’s defense was similar, with denial of any form of tax avoidance and stating further than the company has and always will pay it’s fair share of taxes

Starbucks made similar arguments.

*

Excerpts from the Questioning by the Public Accounts Committee.

How did these companies go about this elaborate system of “exporting profits” to other countries, to avoid their bracket?

I could not possibly list all the methods used for you fill a small book with them.

To paraphrase however.

Google –

Operated from it’s European Headquarters in Dublin, Ireland, which has a comparatively lower tax bracket. Hence all payments from advertisees (including those from the United Kingdom) were considered effected in Ireland and not the UK. Hence the company was only obligated to pay taxes there.

Amazon –

Operated from it’s European Headquarters in Luxembourg. All payments for products shipped were sent directly to the HQ in Luxembourg, where once again the tax bracket on corporations is lower than the UK. Taxes on sales effected in the United Kingdom were paid to the Luxembourg government instead.

Starbucks –

The company used complex financial maneuvers, such as borrowing at exorbitant interest rates from other parts of the business (thus reducing it’s profit in the UK, but increasing it, in another country from where the funds were “borrowed”)

They purchased coffee beans from Switzerland instead of the UK.

And also used royalty transfers to a sister company in the Netherlands.

A four month investigation by Reuters found that over the last fourteen years, Starbucks has paid only 13,000,000 USD in taxes on upwards of 4 billion USD in revenues.

*

While these companies have been consistently paying less than 2% tax for years in a country where considerable sales are effected year after year. This low tax amount is perfectly legal as has been pointed out by Financial experts, MPs and the companies themselves.

The primary arguments posed to the executives are the plausibility of their low profit figures in the UK (particularly when compared to their substantial revenues), and the morality of their otherwise legal tax avoidance. However, morality is a highly subjective matter, hence the purpose of laws and rules. They put morality across in a manner as dis ambiguous as is possible. And so if companies are able to do things that are arguably immoral, but perfectly legal, then the onus should lie, not with the companies, but with the Government of the concerned nation, who’s less than perfect regulations allow it.

If members of parliament are allowed decide on the fate of massive corporations and their thousands of employees, then we are vesting far too much power into the human, subjective hands of people

In the words of Justice Billings Learned Hand

“There is nothing sinister in so arranging ones affairs as to keep taxes as low as possible, for nobody owes any public duty to pay more than the law demands”

*

If you walk in the woods at night, would you blame the wolves for your perils? Law’s are meant to be watertight.

Further, cunning practices such as these bring out other negative consequences.

1. Countries fearing such elaborate tax avoidance might pass and enforce much stricter tax laws. For instance laws that require it to pay taxes, without considerations for double taxation that might happen on taxes it will have to pay abroad.

2. Other companies, might follow in their footsteps, making Tax avoidance a business practice. (Nothing illegal about it)

3. It is a practice that is unfair to smaller UK based companies and business, as these avenues of lowering their net tax liability are not available to them.

4. It is unfair to the people of the United Kingdom, as companies operate and make money hand over fist in the UK, but do not pay their fair share of tax.

*

If anyone here is to blame, it is the government of the United Kingdom. If one’s laws are inadequately framed then one must not feel slighted when people find their way past them.

Note:

The moral high ground taken by the Chairwoman of the Public Accounts Committee had brought into question recently when she was implicated in a matter of tax avoidance herself. Read more here –

That is a lot of money saved. Effectively, British citizens are paying to strengthen the United State of America, enrich multi-nationals who will then exert influence on developing nations, and obtain political and economic advantage t the Great Powers. Maybe USA-UK political relations demand such favourable financial regulations to American companies. There must be an inherent give-take at the highest levels.

Why else, did Tony Blair support the US to attack Iraq, and recently confess the lack of evidence for weapons of mass destruction in Saddam Hussein’s Iraq?

LikeLike